- LATEST

- WEBSTORY

- TRENDING

BUSINESS

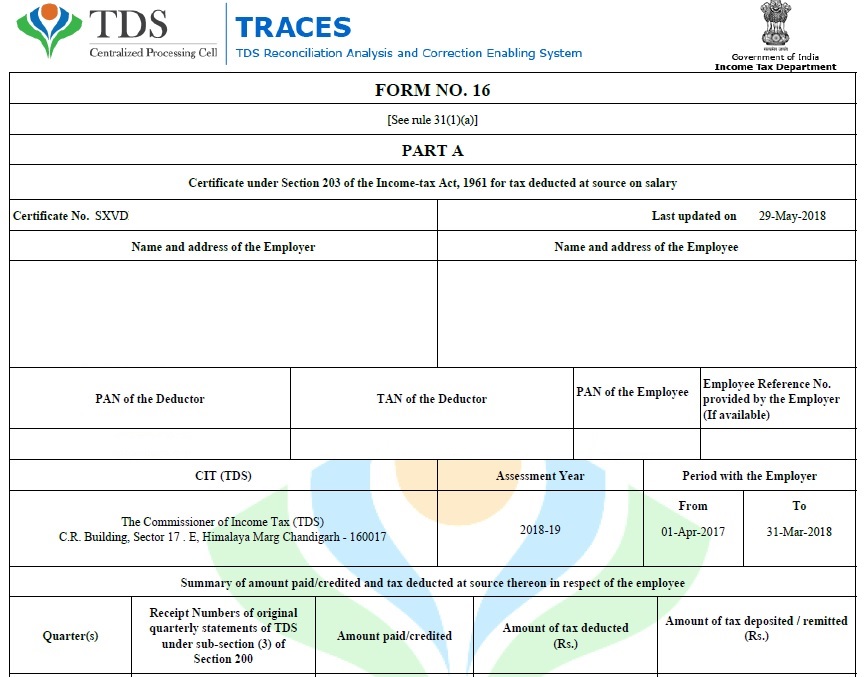

Income Tax Return Filing 2025-26: What is Form 16? Why should you not claim false deductions?

While filing the Income Tax Return, never claim false deduction under sections 80C, 80D and other sections as it may create problems because the Income Tax Department can successfully track your expenditures or investments using Artificial Intelligence.

TRENDING NOW

The deadline for filing the Income Tax Return for the Financial Year 2024-25 has been extended to September 15. You have enough time, but you can start early to avoid a last-minute rush and related complications. It has come as a big relief, particularly for those taxpayers who have received their Form 16 by June 15 and are expected to complete the formalities by July 31. Form 16 is a TDS certificate issued by the employer for the following financial year. It is issued after the end of the financial year in which the income was earned.

False claims of deduction

While filing the Income Tax Return, never claim false deduction under sections 80C, 80D and other sections as it may create problems because the Income Tax Department can successfully track your expenditures or investments using Artificial Intelligence. The Income Tax Department has sent notices to hundreds of thousands of taxpayers in the last three years. Some taxpayers have misused this facilities as there is no need to attach documentary evidence while submitting I-T returns.

However, it may create problems as the Income Tax Department I-T can track and analyse your finance data using Annual Information Statement (AIS) and AI tools. It can send you a notice asking you to furnish proof and explain the discrepancies.

Changes in Income Tax Forms

It is important to note that the Income Tax Department has made certain changes in the Income Tax forms and has notified them. It notified ITR forms for FY 2024-25 (Assessment Year 2025-26) last month, incorporating the changes announced in Union Budget 2024-25.

Who should choose ITR-1?

Salaried individual taxpayers with less complicated tax information should opt for ITR-1, which is a simple form with pre-filled details. It is for those taxpayers, who have a total annual income of Rs 50 lakh or less, which can include salary, pension, interest, dividend, and agricultural income of up to Rs 5,000.

ITR- 2

ITR-2 is for those taxpayers, who have no income under the head ‘profits and gains from business or profession’. In other words, the salaried individuals who are not eligible to use ITR-1 should choose ITR-2.

ITR- 3

ITR-3 is for those people who go for stock trading activities like intra-day or F&O trading, these activities will be treated as business income. Besides, ITR-3 should also be chosen by those Individuals and Hindu Undivided Families (HUF) who have income under the head ‘profits and gains of business or profession.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)