- LATEST

- WEBSTORY

- TRENDING

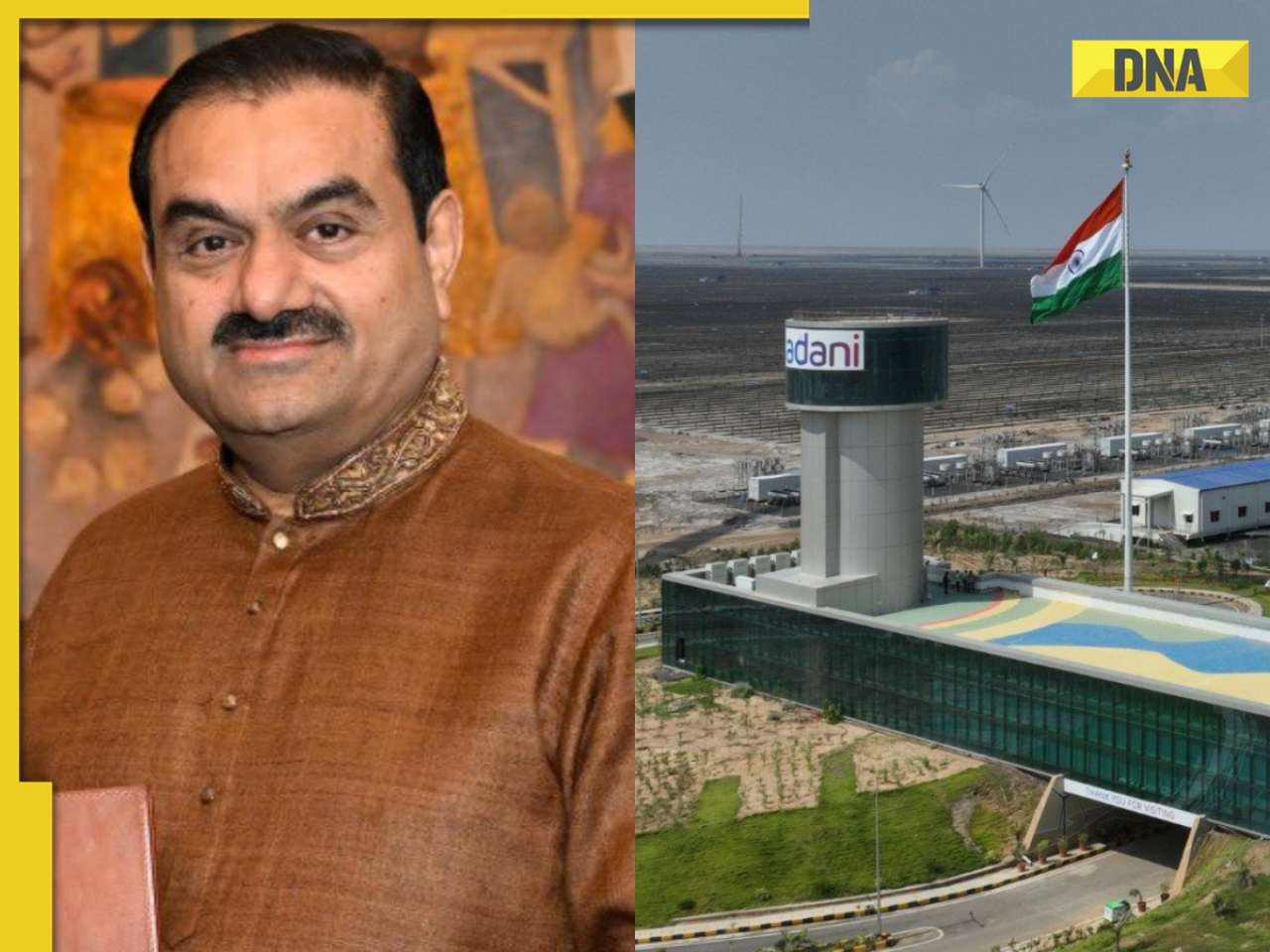

BUSINESS

By raising Rs 17,600 crore, Anil Ambani set for a REVIVAL, here’s how

Anil Ambani is experiencing a financial turnaround as he plans to raise Rs 17600 crore for his companies, Reliance Infrastructure and Reliance Power.

TRENDING NOW

Anil Ambani, the younger brother of Asia's richest man, Mukesh Ambani, has faced significant challenges in his business endeavors over the years. However, he is now experiencing a noteworthy turnaround with his two major companies, Reliance Infrastructure Limited and Reliance Power Limited—starting to recover and nearly achieving a debt-free status.

Taking advantage of this recent positive shift, Anil Ambani plans to raise an impressive Rs 17,600 crore to give a much-needed boost to his businesses, particularly his flagship companies, Reliance Infrastructure and Reliance Power. There is growing speculation that this move could significantly alter his business trajectory and impact the market.

How Anil Ambani Raised the Funds

According to reports, Anil Ambani’s Reliance Group has recently raised Rs 7,100 crore through equity-linked long-term Foreign Currency Convertible Bonds (FCCB) from Värde Partners, a well-known global investment fund based in the United States. This amount will be available for 10 years at a 5% interest rate, providing a solid financial base for his companies.

In addition to this, both Reliance Power and Reliance Infrastructure plan to raise another Rs 6,000 crore through Qualified Institutional Placement (QIP). Notably, the two companies have already announced a preferential issue of equity shares to raise Rs 4,500 crore in the past two weeks. Overall, the Reliance Group aims to raise a total of Rs 17,600 crore, pending approval from shareholders, which is expected by the end of October.

Anil Ambani's Big Plan

According to officials from Reliance Group, Anil Ambani intends to increase the valuation of both his companies. The Rs 17,600 crore being raised will have a favorable debt-to-equity ratio of 70:30. This strategy of raising funds through equity or equity-linked long-term bonds is viewed as an effective approach for the Reliance Group, providing the necessary capital for expanding its operations.

Analysts believe that this favorable debt-to-equity ratio will allow Reliance Power and Reliance Infrastructure to potentially attract up to Rs 50,000 crore in investments over the next few years, which could elevate the market capitalization of these companies to Rs 25,000 crore each.

Share Performance

Meanwhile, the share prices of Reliance Power have fluctuated recently, currently standing at ₹50.95 after a 5% decline on Friday, following an impressive 5% increase over 11 consecutive days. Despite this dip, Reliance Power has delivered a remarkable 170% return this fiscal year. Similarly, Reliance Infrastructure has also provided around 128% returns to its investors this year, with its shares currently priced at ₹300, although they have seen a downward trend in recent days.

This turn of events for Anil Ambani marks a potential new chapter for his businesses, as he works to solidify their financial standing and growth prospects in the coming years.

The DNA app is now available for download on the Google Play Store. Please download the app and share your feedback with us.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)